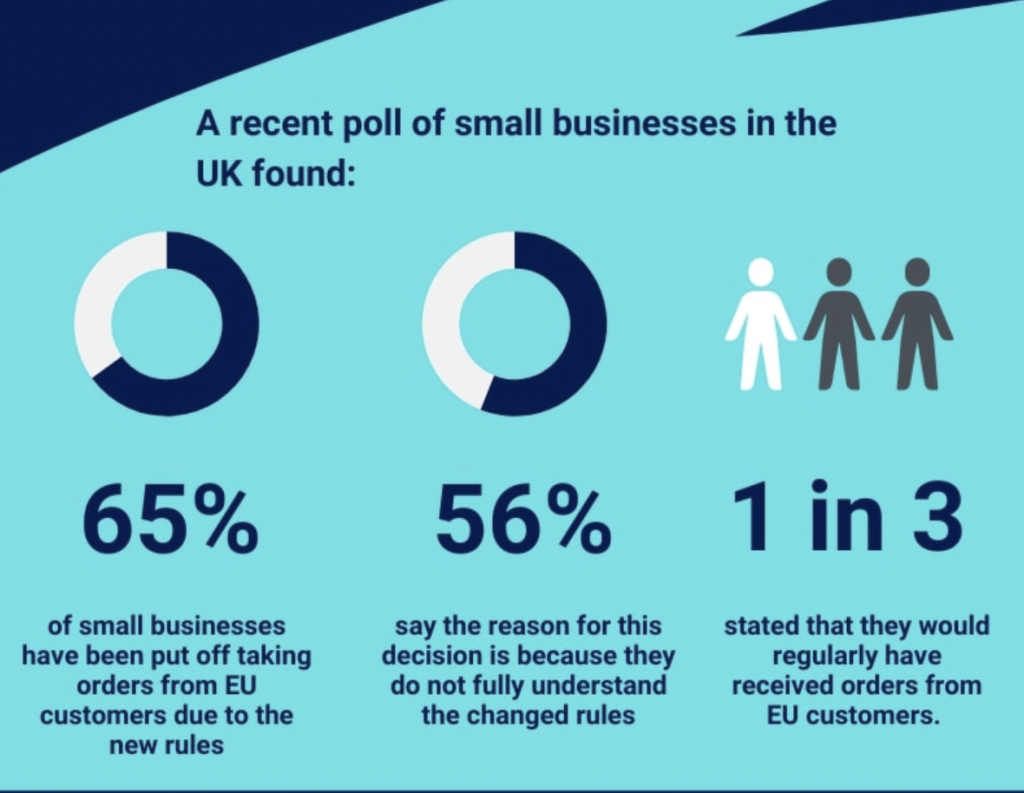

Home and housewares retailers are among the 65% of small UK businesses that have been put off taking orders from EU customers, according to a recent poll by the online magazine Shop Small, Love Local.

From the beginning of July, the EU introduced new rules on how VAT is accounted for on cross-border trade. As a result, businesses selling good valued at €150/£135 or below to customers in the EU need to charge import VAT.

When asked why they were put off taking orders from customers in the EU, some 56% of small businesses said they did not fully understand the changed rules. A further 22% were worried about the cost implications for their business. According to Shop Small, Love Local the main area of confusion for small business owners is how to calculate, collect and pay the VAT due on sales.

Poll respondents included small businesses from across the UK selling goods including homeware and gift retailers. A third of respondents stated that they would regularly have received orders from EU customers.

Online kitchenware and homeware retailer Ross Martin owner of Unfound Home, commented on the new rules stating: “As a UK based online business, we strive to be able to diversify our income opportunities. Due to Brexit and the new regulations that we face, if we wish to sell to EU countries, we now have to be EORI registered and abide by the import and export duties regulations as a company.”

Ross continued: “These are additional strains on small businesses. We are in a catch twenty-two scenario…if we do not take the risk, we cannot reap the reward”.

Meanwhile Bira and the FSB are among organisations offering advice to independent retailers that are selling to EU customers.