The Budget – which was delivered yesterday by Chancellor Rishi Sunak – provoked positive and mixed reactions from cookshops and housewares retailers. Featuring a £30bn package to help the UK economy respond to the coronavirus, The Budget includes emergency measures aimed at helping small retailers cope with the coronavirus (Covid-19) crisis.

The measures include a 12-month business rates ‘holiday’ for retailers with rateable values of under £51,000, as well as a commitment from the government to pay Statutory Sick Pay for up to 14 days for any workers impacted by coronavirus in a business with less than 250 staff.

The Chancellor described the tax holiday as an “exceptional step,” stating that it could save “each business up to £25,000.” He also announced that there is to be a review of general business rates later this year.

Echoing the thoughts of Bira (see below) and a multitude of independent cookshop owners, Holly Wilson of Prep Cooksop and Richard Dare in North London (Bira Cookshop of the Year in the 2019 Excellence in Housewares Awards) hopes the measures “will make the tough times slightly easier.”

However, other independents were among those disappointed with The Budget. “This short-term fix is welcome news for many retailers across the country,” recognises David Caldana, co-founder of Borough Kitchen (with four cookshops in London). “However, the £51,000 threshold ignores retailers who are stuck in areas with higher rateable values, who will get no relief whatsoever, despite paying 60% on top of already incredibly high rents.”

David continues: “The rates system is broken and needs a proper long-term fix that levels the playing field with online-only retailers.”

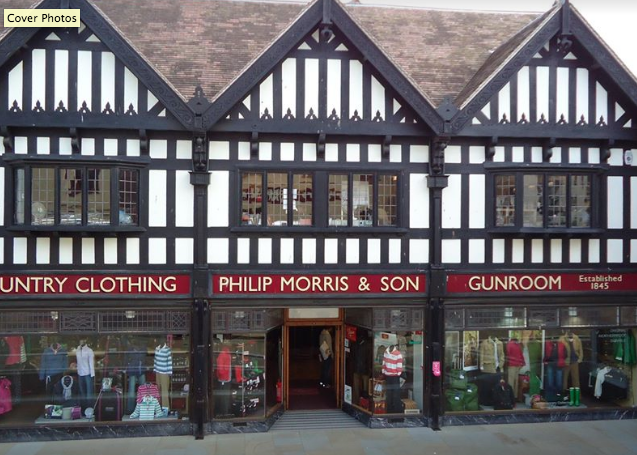

Similar sentiments come from John Jones, managing partner of Philip Morris & Son in Hereford,” who states: “I can see that for many small businesses it is a good budget, but for us it has rather missed the mark.”

John continues: ”Our rateable value is just over the 51K threshold, so we miss out completely. We’ve already been massively hit on footfall, with people avoiding coming to town since the start of the month, and takings in-store are down accordingly. With the relief not extending to us we have to carry on with all the same overheads, but less customers; hence for us it isn’t a great budget.”

There is an element of hope, as John adds: “The one thing I really welcome is the proper review of business rates that has been announced, but we’ve been down this road before without any change happening. Fingers crossed for a better outcome from this review.”

Meanwhile Kim Foster, owner of Copperfields of Whitstable describes the business rates break as “a great help” but says: “It should have been done before the coronavirus.” He also explains that with Copperfields’ revaluation in 2018, the shop’ rates “went from £7,200 to £14,970 per annum last year,” highlighting that the “whole business rates system needs to be looked at.”

Kim also points out that the system is “extremely unfair and in my mind discriminatory against those with retail premises.”

Commenting on the measures to pay sick pay for up to 14 days, David at Borough Kitchen states: “Any measures that will help our team members are welcome. However, the government has a lot more to do to ensure that workers and small businesses are not penalised because of this public health emergency.”

Kim Foster recognises that payment of statutory sick pay will be helpful, but highlights a bigger concern for businesses such as Copperfields: “If you have to close your business for two weeks or more you cannot make any claim to your Insurers – you are not covered for loss of business.” He emphasises: “The biggest impact will be business closure and the negative impact in your area of trading.”

At Philip Morris & Son, John Jones comments: “The statutory sick pay may be of value if we get significant infection rates amongst the staff, but obviously we are taking measures to avoid spread of infection, and hoping not to have too many off sick.”

At leading online and bricks and mortar retailer Harts of Stur (in Sturminster Newton), purchasing director David Conduit summed up: “From a business perspective, the autumn report into business rates restructuring will be very welcome, and should Covid-19 really bite, the refund of SSP is a help.”

Representing hundreds of cookshops and housewares stockists, The British Independent Retailers Association (Bira) welcomes the Chancellor’s measures to help small retailers as coronavirus cases multiply in the UK. The association had issued a plea to the Chancellor to help independent retailers prior to the Budget.

In addition to the business rates ‘holiday’ and sick pay payments, Bira also highlighted the ‘business Interruption’ loans of up to £1.2 million for small retail businesses, and that any company eligible for small business rates relief will be allowed a £3,000 cash grant.

However, Bira had hoped for an announcement about plans to reform the out-dated business rates system yesterday, having campaigned tirelessly for an overhaul over the past few years. However it does welcome the promise of £5bn investment in broadband in the country’s hardest-to-reach areas as a further boost to business.

Andrew Goodacre, Bira’s ceo states: “We are delighted to see that the Chancellor listened to our concerns regarding the potential impact of Covid19. The retail discount being increased to 100%, the support with SSP and small business grants are all very welcome.”

However, Andrew continued: “We still have concerns for those retailers above the £51,000 threshold and believe that the threshold should be increased to include more smaller retailer businesses with less than 250 employees.”